Crypto Arbitrage Trading Strategies: Unlocking Profit Opportunities

Introduction

Crypto arbitrage trading has gained popularity as a strategy to profit from price differences across various cryptocurrency exchanges. However, it’s not a one-size-fits-all approach, and success depends on understanding the nuances of this trading method. In this article, we’ll explore “147. Crypto arbitrage trading strategies” to help you navigate the world of crypto arbitrage effectively.

Understanding Crypto Arbitrage

What Is Crypto Arbitrage?

Crypto arbitrage is a trading strategy that exploits price differences of the same cryptocurrency on different exchanges. Traders buy low on one exchange and sell high on another to profit from the spread.

Types of Arbitrage

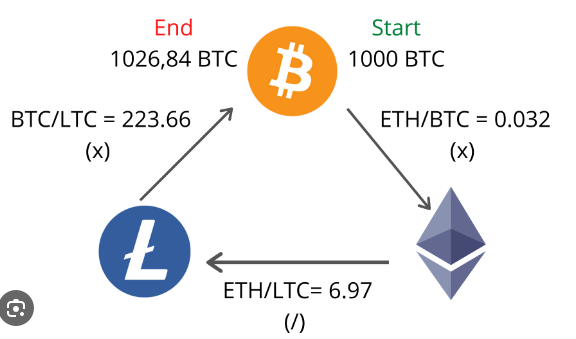

There are three primary types of crypto arbitrage:

- Spatial Arbitrage: Involves buying on one exchange and selling on another due to price disparities.

- Temporal Arbitrage: Capitalises on price differences over time, such as buying a futures contract at a lower price and selling when it matures at a higher price.

- Statistical Arbitrage: Utilises statistical models to identify opportunities based on historical price relationships.

Crypto Arbitrage Trading Strategies

1. Spatial Arbitrage

Spatial arbitrage is the most common form of crypto arbitrage. It involves taking advantage of price differences between different exchanges at the same time.

How It Works:

- Monitor multiple cryptocurrency exchanges for price disparities.

- Identify an asset with a price difference worth exploiting.

- Buy the asset on the exchange where it’s cheaper.

- Sell the asset on the exchange where it’s more expensive.

- Ensure transaction costs do not eat into profits.

2. Temporal Arbitrage

Temporal arbitrage involves profiting from price differences that occur over time, such as futures contracts or lending rates.

How It Works:

- Identify a cryptocurrency with price disparities over time.

- Buy the asset when the price is lower.

- Hold the asset until its price increases.

- Sell the asset for a profit.

3. Statistical Arbitrage

Statistical arbitrage relies on mathematical models and historical data to identify trading opportunities.

How It Works:

- Develop a statistical model that considers price relationships between multiple cryptocurrencies.

- Identify when the model predicts a profitable trade.

- Execute the trade based on the model’s recommendations.

Risks and Challenges

Market Volatility

Cryptocurrency markets are known for their extreme volatility, which can lead to sudden price fluctuations that affect arbitrage opportunities.

Transaction Costs

Transaction fees and spreads can eat into profits, especially for small price differences.

Liquidity

Some cryptocurrencies may lack liquidity, making it challenging to execute large trades without significant price impact.

Exchange Restrictions

Exchanges may impose limits on withdrawals or deposits, affecting the movement of funds required for arbitrage.

Best Practices for Crypto Arbitrage

1. Real-Time Monitoring

Use crypto arbitrage software or tools to monitor prices across multiple exchanges in real-time.

2. Risk Management

Allocate only a portion of your capital to arbitrage trading to manage risks.

3. Transaction Speed

Execute arbitrage trades quickly to capitalise on price disparities before they disappear.

4. Exchange Selection

Choose exchanges with lower fees, higher liquidity, and reliable execution for your arbitrage trades.

FAQs about Crypto Arbitrage Trading

FAQ 1: Is crypto arbitrage risk-free?

No, crypto arbitrage carries risks, including market volatility and transaction costs. Profit is not guaranteed.

FAQ 2: Can I arbitrage trade with any cryptocurrency?

You can arbitrage trade with many cryptocurrencies, but some assets may have limited arbitrage opportunities due to low liquidity.

FAQ 3: Do I need significant capital for crypto arbitrage?

While arbitrage trading can be conducted with varying amounts of capital, having more substantial capital can lead to more significant profits.

FAQ 4: Are there arbitrage opportunities in decentralised exchanges (DEXs)?

Arbitrage opportunities exist in DEXs, but they may differ from those in centralised exchanges due to liquidity and trading pairs.

Conclusion

Crypto arbitrage trading is a strategy that offers the potential for profit by exploiting price disparities between cryptocurrency exchanges. It requires careful planning, real-time monitoring, and risk management to be successful. By understanding the different types of arbitrage and the associated risks, traders can navigate this space more effectively and capitalise on arbitrage opportunities in the dynamic world of cryptocurrencies.

Read more Mastering the Art of Yield Farming on Binance Smart Chain