Introduction

Crypto investment portfolio management Investing has evolved significantly over the years, with traditional options like index funds now competing with the exciting world of cryptocurrencies. In this article, we will conduct a thorough examination of the pros and cons of investing in cryptocurrencies versus index funds, shedding light on the complexities of portfolio management in the digital age.

Understanding Index Funds

What Are Index Funds?

An introduction to index funds, explaining their structure and investment approach.

Benefits of Index Funds

A discussion of the advantages of investing in index funds, including diversification and passive management.

Chapter 2: Cryptocurrencies Demystified

What Are Cryptocurrencies?

An overview of cryptocurrencies, highlighting their decentralized nature and digital properties.

The Crypto Market

Exploring the dynamics of the cryptocurrency market, including volatility and liquidity.

Investment Objectives

Short-Term vs. Long-Term Goals

Guidance on aligning investment choices with specific financial objectives.

Risk Tolerance

An examination of how risk tolerance plays a crucial role in choosing between cryptocurrencies and index funds.

Portfolio Management

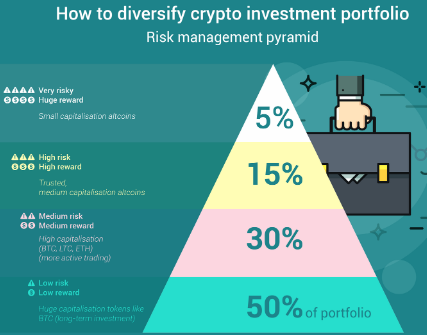

Crypto Investment Portfolio

Insights into building and managing a cryptocurrency portfolio, including asset selection and risk management.

Index Fund Portfolio

Strategies for constructing an index fund portfolio that aligns with an investor’s goals.

Returns and Volatility

Historical Performance

An analysis of historical returns for both cryptocurrencies and index funds.

Volatility Comparison

Comparing the volatility of cryptocurrencies to that of traditional stock market indices.

Liquidity and Accessibility

Liquidity in Cryptocurrencies

Exploring the liquidity of cryptocurrencies and its impact on trading and investment.

Accessibility to Index Funds

Discussing the ease of access to index funds through brokerage accounts.

Regulatory Environment

Regulatory Challenges in Crypto

An overview of the regulatory challenges and considerations associated with cryptocurrency investments.

Index Funds and Regulation

A look at how index funds are regulated and the investor protections in place.

Tax Implications

Cryptocurrency Taxes

Explaining the tax implications of trading and holding cryptocurrencies.

Index Fund Taxation

Discussing the tax treatment of index fund investments.

FAQs about Cryptocurrency vs. Index Funds

FAQ 1: Can I invest in both cryptocurrencies and index funds in the same portfolio?

Guidance on diversifying a portfolio with both asset classes and managing the associated risks.

FAQ 2: Which is more suitable for long-term retirement planning, cryptocurrencies, or index funds?

A discussion on long-term retirement planning and the role of each investment option.

FAQ 3: Are there any age-related considerations when choosing between cryptocurrencies and index funds?

An exploration of how an investor’s age and financial situation can impact their investment choices.

FAQ 4: What role does diversification play when deciding between cryptocurrencies and index funds?

An explanation of diversification and its relevance in both cryptocurrency and index fund portfolios.

Conclusion

Choosing between cryptocurrencies and index funds is a decision that depends on various factors, including investment objectives, risk tolerance, and regulatory considerations. While cryptocurrencies offer exciting opportunities for growth, index funds provide a stable and diversified approach to investing. Ultimately, the right choice depends on individual circumstances and financial goals, and a well-informed decision can lead to a more successful and rewarding investment journey.

Read more How to Mine for Bitcoin on a Budget: A Comprehensive Guide