Analysing the SEC’s Reaction to Crypto Lending: Impact and Implications

Introduction

The world of cryptocurrency lending has seen substantial growth in recent years, offering individuals and institutions opportunities to earn interest or secure loans against their digital assets. However, as this sector has expanded, it has drawn regulatory scrutiny, particularly from the U.S. Securities and Exchange Commission (SEC). In this article, we will delve into the SEC’s reaction to crypto lending and explore its implications for the industry, with a focus on “148. Crypto lending platforms fees.”

Crypto Lending Platforms

What Are Crypto Lending Platforms?

Crypto lending platforms allow users to lend their digital assets to others in exchange for interest payments. These platforms also enable borrowers to secure loans by using their crypto holdings as collateral.

Popular Crypto Lending Platforms

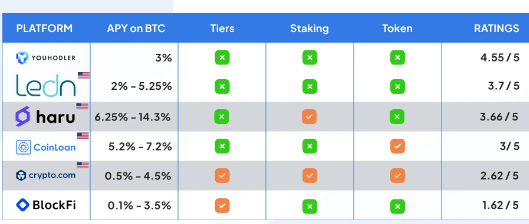

We’ll briefly introduce some well-known crypto lending platforms, including Celsius Network, BlockFi, and Nexo.

The SEC’s Concerns

Securities or Not?

The SEC has been grappling with the question of whether certain crypto lending products should be classified as securities. This classification would subject them to more stringent regulations.

The BlockFi Investigation

We’ll examine the SEC’s investigation into BlockFi, a major crypto lending platform, and its impact on the industry.

Implications for Crypto Lenders and Borrowers

Increased Regulatory Scrutiny

The SEC’s actions have highlighted the need for crypto lending platforms to comply with existing securities laws, potentially leading to increased regulatory oversight.

Impact on Interest Rates and Fees

Crypto lending platforms may need to adjust their interest rates and fees to account for regulatory compliance and potential legal costs.

Borrower Eligibility

Changes in regulations could affect who can borrow from crypto lending platforms and the terms of their loans.

The Debate Over Regulation

Industry Perspectives

We’ll explore the varying opinions within the crypto community regarding SEC regulation of crypto lending, including arguments for and against.

Balancing Innovation and Investor Protection

The SEC faces the challenge of striking a balance between fostering innovation in the crypto lending space and protecting investors from potential risks.

FAQs about the SEC and Crypto Lending

FAQ 1: What is the SEC’s primary concern with crypto lending platforms?

The SEC is primarily concerned with whether some crypto lending products should be classified as securities, which would subject them to more stringent regulations.

FAQ 2: Are all crypto lending platforms under SEC scrutiny?

While not all crypto lending platforms are currently under SEC scrutiny, the regulatory landscape is evolving, and more platforms may come under examination in the future.

FAQ 3: How can crypto lending platforms ensure compliance with SEC regulations?

Crypto lending platforms can seek legal counsel, conduct internal audits, and engage with regulators to ensure they comply with SEC regulations.

FAQ 4: How will the SEC’s actions affect crypto lending fees?

The SEC’s actions could lead to changes in crypto lending fees as platforms may need to allocate resources for regulatory compliance and potential legal expenses.

Conclusion

The SEC’s reaction to crypto lending represents a significant development in the cryptocurrency industry. While regulatory clarity is essential for the long-term stability and growth of the sector, it also raises questions about the future of innovation and access within the crypto lending space.

Crypto lending platforms, borrowers, and investors must stay informed about regulatory developments and adapt to the changing landscape. As the SEC continues to define its stance on crypto lending, the industry will need to navigate these challenges while striving to provide innovative and compliant solutions for users.

Read more Unraveling the Complexity of Crypto Tax Reporting: Your Guide to Crypto Tax Reporting Tools