Introduction

Crypto lending platforms interest rates Bitcoin lending has gained popularity as a way for cryptocurrency holders to earn interest on their assets. However, the interest rates offered on these platforms can vary significantly. In this article, we will delve into the factors that determine interest rates for Bitcoin lending, shedding light on the intricacies of this fascinating financial ecosystem.

Understanding Bitcoin Lending

What Is Bitcoin Lending?

We’ll provide a comprehensive explanation of Bitcoin lending, highlighting its purpose and how it differs from traditional lending.

How Bitcoin Lending Works

A step-by-step breakdown of how Bitcoin lending platforms operate, including the roles of borrowers and lenders.

The Role of Interest Rates

The Significance of Interest Rates

Interest rates are a key element of Bitcoin lending, influencing both lenders and borrowers. We’ll discuss why they matter.

Borrower’s Perspective

We’ll explore how interest rates affect borrowers, including their borrowing costs and profitability.

Lender’s Perspective

From the lender’s point of view, we’ll discuss how interest rates determine the potential returns on their Bitcoin holdings.

Factors That Determine Bitcoin Lending Interest Rates

Supply and Demand

The fundamental principle of supply and demand plays a significant role in interest rate determination. We’ll explain how this works in the context of Bitcoin lending.

Platform Policies

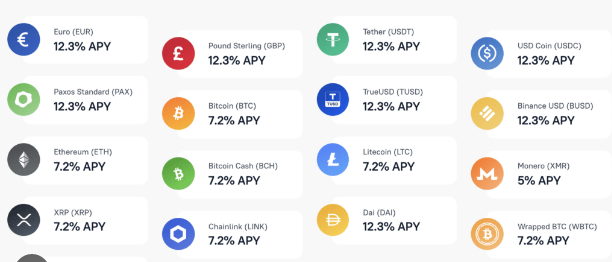

Different lending platforms have their policies regarding interest rates. We’ll delve into how these policies affect rates.

Market Volatility

The volatility of the Bitcoin market can impact interest rates. We’ll explore how market conditions influence lending rates.

Types of Bitcoin Lending Platforms

Centralised Lending Platforms

Centralised lending platforms have a centralised authority that determines interest rates. We’ll discuss how they operate.

Decentralised Lending Platforms

Decentralised lending platforms often rely on smart contracts and algorithms to set interest rates. We’ll explore how decentralisation impacts rates.

Risks and Rewards

Risks for Borrowers

Borrowers face certain risks when seeking Bitcoin loans, including fluctuating interest rates. We’ll outline these risks.

Risks for Lenders

Lenders also face risks, such as default by borrowers. We’ll examine the potential pitfalls for lenders.

Potential Rewards

Despite the risks, Bitcoin lending offers potential rewards, including the opportunity to earn interest income. We’ll discuss the benefits.

FAQs about Bitcoin Lending Interest Rates

FAQ 1: Can Bitcoin lending interest rates be negative?

Yes, in some cases, Bitcoin lending interest rates can be negative, meaning that lenders pay borrowers.

FAQ 2: How often do Bitcoin lending interest rates change?

Interest rates on Bitcoin lending platforms can change frequently, often in response to market dynamics.

FAQ 3: Are Bitcoin lending platforms regulated?

Regulation of Bitcoin lending platforms varies by jurisdiction, with some operating in a regulatory grey area.

FAQ 4: Is Bitcoin lending safe?

While Bitcoin lending can be safe, it carries risks, including the potential for default by borrowers and market volatility.

Conclusion

Interest rates for Bitcoin lending are influenced by a complex interplay of factors, including supply and demand, platform policies, and market conditions. Whether you’re a borrower seeking affordable financing or a lender looking to maximize your returns, understanding the dynamics behind these rates is essential. Bitcoin lending continues to evolve, offering both opportunities and challenges to participants in this exciting financial ecosystem.

Read more The Safe Haven: Exploring the World of Crypto Lending Platforms and Their Security