Introduction

How to analyze crypto projects Cryptocurrency, the revolutionary digital currency that emerged in the last decade, has captivated the world with its potential for financial innovation and empowerment. However, like any financial instrument, it comes with its set of advantages and disadvantages. For beginners and seasoned investors alike, understanding the pros and cons of cryptocurrency is essential. In this comprehensive guide, we will explore the benefits and drawbacks of cryptocurrencies, as well as provide insights into how to analyse crypto projects effectively.

Table of Contents:

- What is Cryptocurrency?

- The Pros of Cryptocurrency

- The Cons of Cryptocurrency

- How to Analyse Crypto Projects Effectively

- Frequently Asked Questions (FAQs)

Let’s start by demystifying the concept of cryptocurrency and then delve into its pros and cons.

What is Cryptocurrency?

Cryptocurrency is a digital or virtual form of currency that relies on cryptography for security. It operates on a technology called blockchain, which is a decentralised and distributed ledger that records all transactions across a network of computers. The most well-known cryptocurrency is Bitcoin, but there are thousands of others, each with its unique features and use cases.

The Pros of Cryptocurrency

a. Decentralisation: Cryptocurrencies operate on a decentralised network of computers, eliminating the need for intermediaries like banks. This can reduce the risk of central authority manipulation.

b. Security: Cryptography makes transactions secure and tamper-resistant. Once recorded on the blockchain, transactions are nearly impossible to alter.

c. Accessibility: Cryptocurrencies are accessible to anyone with an internet connection, providing financial services to the unbanked and underbanked populations.

d. Transparency: Blockchain technology offers transparency, as all transactions are recorded publicly. This reduces fraud and enhances trust in the system.

e. Speed and Low Fees: Cryptocurrency transactions can be processed quickly, often faster than traditional banking methods. Transaction fees are typically lower, especially for international transfers.

f. Financial Inclusion: Cryptocurrencies can provide financial services to those without access to traditional banking, bridging the global financial inclusion gap.

g. Investment Opportunities: Cryptocurrencies offer investment opportunities, with some assets experiencing significant price appreciation.

The Cons of Cryptocurrency

a. Volatility: Cryptocurrencies are known for their price volatility, which can result in substantial gains but also steep losses.

b. Lack of Regulation: The absence of comprehensive regulation can lead to scams, fraud, and market manipulation.

c. Security Risks: While blockchain itself is secure, users are susceptible to phishing attacks, hacks, and wallet vulnerabilities. Irreversible transactions can lead to loss of funds.

d. Limited Acceptance: Not all merchants and service providers accept cryptocurrencies as a form of payment, limiting their utility.

e. Tax Implications: Cryptocurrency transactions can have complex tax implications, with regulations varying by country.

f. Environmental Concerns: The energy-intensive process of mining cryptocurrencies, especially Bitcoin, has raised environmental concerns due to its carbon footprint.

g. Technological Challenges: Cryptocurrency technology is evolving rapidly, which can pose challenges for beginners and require continuous learning.

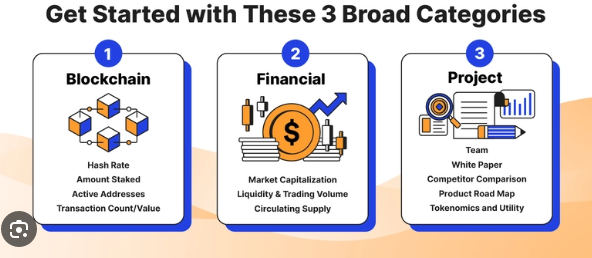

How to Analyse Crypto Projects Effectively

To navigate the world of cryptocurrencies and make informed decisions, consider the following when analysing crypto projects:

a. Team and Leadership: Research the team behind the project. Look for experienced and transparent leadership with a track record of success.

b. Use Case: Understand the project’s purpose and how it solves real-world problems. Does it have a unique and valuable use case?

c. Technology: Assess the project’s underlying technology, including its scalability, security features, and consensus mechanism.

d. Community and Adoption: A strong and engaged community can indicate a project’s potential for growth. Look for partnerships and real-world adoption.

e. Roadmap and Updates: Review the project’s roadmap and how well it has delivered on its milestones. Regular updates and transparency are positive signs.

f. Security: Investigate the project’s security measures, especially if it involves smart contracts. Has it undergone third-party audits?

g. Whitepaper: Read the project’s whitepaper, which outlines its goals, technology, and implementation plans.

h. Market and Competition: Analyse the project’s position in the market and its competition. Is there a demand for its product or service?

Frequently Asked Questions (FAQs)

Q1: Can I become a millionaire by investing in cryptocurrencies?

A1: While some individuals have experienced significant gains, investing in cryptocurrencies carries risks, and it’s essential to conduct thorough research and only invest what you can afford to lose.

Q2: Are cryptocurrencies legal worldwide?

A2: Cryptocurrency regulations vary by country. Some countries embrace them, while others impose restrictions or outright bans. It’s crucial to be aware of your country’s regulations.

Q3: How can I store my cryptocurrencies securely?

A3: Consider using hardware wallets or secure software wallets, enabling two-factor authentication (2FA), and practising good cybersecurity hygiene.

Q4: Is cryptocurrency mining still profitable?

A4: Cryptocurrency mining can be profitable, but it depends on factors like electricity costs, hardware, and the specific cryptocurrency being mined. It’s essential to calculate potential returns before investing in mining equipment.

Conclusion

Cryptocurrency represents a revolutionary shift in the world of finance, offering both opportunities and challenges. As a beginner, understanding the pros and cons of cryptocurrency is essential to make informed decisions and navigate this dynamic space successfully. While cryptocurrencies offer decentralisation, security, and accessibility, they also come with volatility, regulatory uncertainties, and security risks. To analyse crypto projects effectively, consider factors like the team, technology, community, and adoption. By staying informed, conducting thorough research, and practising prudent investment strategies, you can harness the potential benefits of cryptocurrencies while mitigating their drawbacks, ultimately contributing to your financial success in the digital age.